Ever found yourself caught in the tangled web of numbers, forms, and regulations that is tax preparation? Ever wished for a magic wand to make it all simpler?

I’ve been there. The endless sea of receipts and paperwork, the sleepless nights worrying about IRS audits—it’s enough to drive anyone up a wall.

You’re not alone in this struggle; countless small businesses face these same challenges every year during tax season.

It doesn’t have to be this complicated. From finding reliable local tax preparers to navigating state laws and maximizing deductions – this guide will cover it all for you.

Table of Contents:

- Tax Preparation for Small Businesses in Northeast Ohio

- Navigating State and Local Tax Laws

- Finding a Local Tax Preparer

- Benefits of Professional Tax Preparation Services

- Guaranteeing Accuracy with Professionals

- Choosing the Right Tax Preparation Service

- Evaluating Customer Reviews

- Considering Cost & Services Provided

- Credentials & Expertise Matter

- Simplicity vs. Complexity: DIY Software or Full-Service Prep?

- DIY Tax Preparation with Tax Software

- Understanding Tax Software Options

- Filing Your Taxes Online: A Closer Look at The Process

- Understanding Tax Forms and Documentation

- Importance of Record-Keeping

- A Closer Look at Common Business Tax Forms

- Maximizing Deductions and Credits for Small Businesses

- Utilizing Life Events for Deductions

- Federal Return Opportunities

- Prior Year Returns: A Gold Mine of Deductions

- Navigating Tax Laws and Regulations for Small Businesses

- Staying Updated with Tax Law Changes

- Taking Advantage of Deductions and Credits

- Getting Professional Help

- Tips for Efficient Tax Filing and Payment Options

- Advantages of Electronic Filing

- Prior Year Return Review

- CPA Needs Can Help You Make the Most of Your Return this Tax Season

- FAQs in Relation to Tax Preparation

- What is the meaning of tax preparation?

- Can you prepare your own tax return?

- What are the 3 ways you can prepare your taxes?

- What happens if you file taxes late?

Tax Preparation for Small Businesses in Northeast Ohio

Small businesses have unique tax situations, and navigating through them can be tricky. But with a clear understanding of state and local tax laws, coupled with professional help or user-friendly tax preparation software like TurboTax, it doesn’t have to be.

Navigating State and Local Tax Laws

The first step towards efficient tax filing is understanding the intricacies of your income tax situation. In Northeast Ohio, this means grasping both state-level regulations as well as local ones.

Your business might need an identification number specific to the area where you operate. It’s also essential to consider if any year-end amendments are necessary due to changes in your trade commission agreements.

Finding a Local Tax Preparer

If dealing with all these variables sounds overwhelming, getting professional assistance from experienced preparers may be beneficial for you. A reliable local expert not only helps file taxes but can offer invaluable advice on how best to manage different aspects of your finances moving forward.

Benefits of Professional Tax Preparation Services

At tax time, small businesses may feel overwhelmed by the task of managing their finances, understanding intricate regulations, and claiming maximum deductions. Balancing the books, navigating complex tax laws, and ensuring maximum deductions can feel overwhelming. But here’s where professional services for your taxes come into play.

Guaranteeing Accuracy with Professionals

No one likes to make mistakes when it comes to their business finances, especially not on their taxes. An error can lead to penalties or lost opportunities for deductions. A tax expert doesn’t just save time; they’re also skilled at spotting those little details that could potentially trigger an IRS audit.

Beyond accuracy and peace of mind, professional help offers additional benefits like:

- Saving Time: The old saying “time is money” rings true here—every hour spent on your own return could be better used running your business.

- Navigating Complex Scenarios: If you have multiple income streams or complicated expenses, professionals use this complexity in favor of reducing overall taxable income.

- Finding Deductions & Credits: A seasoned pro knows exactly what financial moves qualify as deductibles, which helps maximize refunds.

Choosing the Right Tax Preparation Service

All these perks sound great, right? But now you might ask yourself, “How do I find a good tax service?” The key lies in evaluating customer reviews and professional credentials. Look for those who have earned positive feedback from their clients or for personal referrals from other small business owners in your community.

Professional tax services ease the stress of small businesses during tax season by ensuring accuracy, saving time, and helping navigate complex scenarios. Not to mention finding deductions and credits that maximize refunds.

Evaluating Customer Reviews

The first step in choosing a service is looking at customer reviews. People who’ve used the service will give you insights that ads and promotional materials won’t.

Beyond just star ratings, though, read through what people have to say about their experiences—were they able to file taxes easily? Was customer support helpful when issues arose?

Considering Cost & Services Provided

Before making a purchase, assess the cost of each service and what you are getting for your money. While some may charge less upfront, they might lack features or support that could end up costing more in the long run due to their effect on your return’s accuracy.

Credentials & Expertise Matter

Taxes can be complex, especially if your situation isn’t simple; having someone knowledgeable handling them makes a huge difference. It’s important, therefore, to ensure whoever handles yours—be it an individual professional or company—has appropriate credentials like CPA certification or enrolled agent status, as well as experience serving similar clients.

Simplicity vs. Complexity: DIY Software or Full-Service Prep?

If your financial picture is relatively straightforward (e.g., single-source income), then using an online self-preparation tool such as TurboTax’s do-it-yourself, which offers step-by-step guidance, might suffice.

But if things get tricky—say you own a business or have rental properties—you might want to consider full-service tax prep. It’s an investment where professionals take care of all the heavy lifting for you.

Choosing the best tax preparation service can not only save you time and money but also prevent unnecessary stress. It’s important to look beyond just star ratings—really dig into customer reviews for more insight. Also, make sure that whoever is dealing with your taxes has the right credentials and experience needed to handle your unique circumstances effectively.

DIY Tax Preparation with Tax Software

Getting your taxes done doesn’t have to feel like pulling teeth. In fact, it can be quite the opposite when you use tax preparation software. A plethora of choices exist that are created specifically for small businesses.

Understanding Tax Software Options

Tax software isn’t one-size-fits-all; each offers unique features that cater to different needs. But which is right for you? Well, if DIY and step-by-step guidance sound appealing, then TurboTax may be your new best friend.

This industry-leading tool provides clear instructions so even beginners can confidently prepare their own returns. It handles everything from income tax calculations to identifying potential deductions, all while ensuring accuracy in compliance with IRS rules.

If getting a quick estimate on your refund sounds helpful, TurboTax’s tax refund calculator is worth checking out, too.

Besides TurboTax, several other players in the online tax prep arena are also worth considering: H&R Block Online and FreeTaxUSA are both user-friendly choices that provide comprehensive support for various tax situations, including filing federal returns or addressing more complex issues such as capital gains or self-employment expenses.

In choosing between these tools, remember this: While some charge service costs upfront, others might seem free initially but later charge extra fees based on specific forms used during the filing process or added services like audit defense protection.

Filing Your Taxes Online: A Closer Look at The Process

The process of using an online platform usually involves creating an account first before diving into data entry work. You’ll need some key pieces of information handy, like your identification number and prior-year return.

Once logged in, the software will guide you through a series of questions designed to gather all necessary data for your tax return preparation.

The challenge is that if you have any complexity in your revenue or tax standing, it can be difficult to get support without paying additional fees. That’s when working with a credentialed, experienced professional rather than an online platform.

Understanding Tax Forms and Documentation

Tax preparation is a crucial endeavor for small enterprises, yet it can be convoluted. The heart of the process lies in understanding tax forms and documentation.

Importance of Record Keeping

To ensure accurate filing, meticulous record-keeping is crucial. This helps to prepare an error-free return while maximizing your deductions.

You might ask, “What records do I need?” For most small businesses in Northeast Ohio or anywhere else, this typically includes receipts for expenses, payroll documents if you have employees, bank statements, and sales invoices, among others.

Your records not only help to file taxes accurately but also serve as proof should there ever be a question about your return by IRS officials. So think of them like lifelines that let you navigate through choppy tax waters with ease.

If managing all these documents seems daunting, don’t worry. There’s help at hand from the Free File Fillable Forms. These are digital versions of paper forms that simplify recording income and calculating taxes owed.

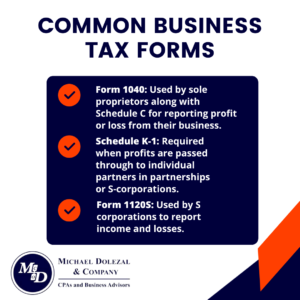

A Closer Look at Common Business Tax Forms

The world of business taxation involves many different forms, each serving a specific purpose depending on various factors such as your business structure or whether you have employees, etc.

- Form 1040: Used by sole proprietors along with Schedule C for reporting profit or loss from their business.

- Schedule K-1: Required when profits are passed through to individual partners in partnerships or S-corporations.

- Form 1120S: Used by S corporations to report income and losses

Remember, these are just a few examples. Depending on your business’s unique tax situation, you may need other forms too.

Maximizing Deductions and Credits for Small Businesses

As a small business owner, maximizing deductions and credits could give your finances an advantageous lift. But navigating the complex tax landscape might feel like trying to find your way through a maze blindfolded.

Utilizing Life Events for Deductions

Believe it or not, life events play an important role in maximizing deductions. For instance, if you’ve recently tied the knot or welcomed a new member into your family, congratulations. These are moments of joy that also come with potential tax benefits.

This is just one example of how life events could influence your taxes as a small business owner. So make sure to consider all significant happenings, from marriage, having kids, and buying homes to even unfortunate circumstances, such as divorce or loss, when preparing taxes.

Federal Return Opportunities

Your federal return offers another area ripe with possibilities for saving money through smart deduction strategies. The IRS E-file status check allows filers access to up-to-date information about their returns, ensuring they don’t miss out on any beneficial updates related to their filings while providing peace of mind at every step of the process.

Prior Year Returns: A Gold Mine of Deductions

Ever heard the saying “history repeats itself”? Taxes tend to follow patterns, and reviewing your prior year’s return can help you uncover deductions that may be relevant for the current tax season. By analyzing your prior year’s return, you can identify potential deductions that may apply again in the current tax season.

Boost your small business finances by making the most of deductions and credits. Use life events, like marriage or having a kid, to find new tax benefits. Also, keep an eye on your federal return and past-year returns; they’re gold mines for smart deduction strategies.

Navigating Tax Laws and Regulations for Small Businesses

Navigating tax law often appears overwhelmingly complex and stressful. But don’t fret. Understanding these intricate regulations isn’t as alarming as it appears.

Staying Updated with Tax Law Changes

Staying abreast of legislative developments is the key to mastering this complex system. Think about how often you check your email or social media feeds; that’s how frequently you should be checking for changes in tax laws.

A significant change could mean the difference between a profitable year and one where Uncle Sam takes more than his fair share. Staying updated helps ensure you never miss out on deductions or credits due to ignorance.

If poring over IRS bulletins sounds less appealing than watching paint dry, consider hiring a professional who does all the heavy lifting for you. Many programs automatically update themselves with new tax codes, so your returns are always accurate.

Taking Advantage of Deductions and Credits

Deductions are like golden tickets in the world of taxes; everyone wants them, but only those who know where to look will find them. Life events such as getting married or buying a home can open doors to these coveted deductions—good news if any big life event happened recently.

Getting Professional Help

If keeping up with all the changes still seems like too much to handle, consider getting professional help. There’s no shame in seeking guidance; after all, even Olympic athletes have coaches.

Tax professionals not only understand current laws but also how they apply to different businesses. They can provide personalized advice tailored to your specific situation; this could mean savings that outweigh their service cost.

Conquer the tax maze for your small business in Ohio. Keep an eye on law changes to stay informed and find deductions. If it’s too much, ask a pro for help. Remember: when you’re ready, file electronically for smooth sailing.

Tips for Efficient Tax Filing and Payment Options

Gaining insight into how to effectively submit taxes is a must for any enterprise, particularly those of the small business variety. When it comes to tax filing, the IRS e-file option has proven to be beneficial.

Advantages of Electronic Filing

The electronic filing system, or e-filing, provides several advantages over traditional paper-based systems. Firstly, using online tax preparation software, you get instant access to your data from anywhere in the world with internet connectivity.

Secondly, the risk of errors is significantly reduced because these software programs come equipped with built-in error-checking features that alert you if there’s something amiss in your form. It means less worry about facing penalties due to inaccuracies on your federal return.

Apart from being accurate and convenient, another benefit is speed, both while preparing tax returns and getting refunds transferred directly into bank accounts via direct deposit options.

That said, these programs are really best applied to simple returns, like those for a single source of income. If you have multiple income streams, are filing for yourself and your business, etc., your best bet is to work with a professional tax preparer instead.

If there’s any complexity to your filing—multiple sources of income, filing for yourself and a business, a major life change—you’re better off working with a professional than using software to file your taxes.

Prior Year Return Review

To ensure more accuracy during this year’s tax filing process, revisiting prior-year returns can help identify overlooked deductions or credits applicable now too. Software companies often include tools for analyzing past years’ data so as not to miss out on any potential savings this time around.

CPA Needs Can Help You Make the Most of Your Return this Tax Season

Navigating tax prep can be a confusing undertaking, but you don’t have to figure it out alone.

Looking for support as you prepare to file taxes for your small business? Whether you’re preparing your federal, state, or local tax returns, we’re here to help. Reach out to our team of tax experts today to ensure you’re filing is correct, timely, and maximizes your refund.

FAQs in Relation to Tax Preparation

What is the meaning of tax preparation?

Tax preparation involves organizing and filing income taxes. It can include calculating deductions, credits, and the total owed.

Can you prepare your own tax return?

Sure thing. You can use online software like TurboTax or manually fill out IRS forms to file on your own.

What are the 3 ways you can prepare your taxes?

You have three options: DIY with paper forms, using tax prep software like TurboTax, or hiring a professional preparer.

What happens if you file taxes late?

Filing late could lead to penalties from the IRS. However, extensions are available if needed.