Table of Contents

- What is the Purpose of Bookkeeping and Financial Reports?

- 5 Reasons To Be Diligent With Your Bookkeeping

- Benefits of Bookkeeping and Financial Reporting

- Types of Books Kept by Businesses

- At the End of the Day

- Michael Dolezal & CO, CPAs & Business Advisors

Dive into financial success by mastering bookkeeping and financial reports’ meticulous art. It’s more than numbers – it’s orchestrating transactions into a record, capturing income, expenses, and other financial activities over a specific time period. Precision guides this dance. These financial accounting records are crucial for businesses to understand their financial health.

Financial reports, on the other hand, refer to the written summarization and presentation of these recorded business transactions in a meaningful way. This involves creating financial statements—the balance sheet, income statement, and cash flow statement —to give you an overview of your company’s financial performance based on accepted accounting principles. These financial snapshots also cover details about cash equivalents, giving you a complete picture of your company’s assets.

What is the Purpose of Bookkeeping and Financial Reports?

Bookkeeping plays a key role in understanding a company’s money situation and finding ways to get even better. By regularly checking financial records, companies can spot patterns, look at costs, and see how much money they’re making. All this info helps them make smart choices, like changing prices, spending less, or finding new ways to make money. Plus, good bookkeeping lets companies keep an eye on cash flow and make sure everything adds up right, with no funny business.

Financial reporting requirements make sure businesses answer to the people who care about them—like investors, shareholders, and the folks in charge of keeping things fair. By using financial statements, businesses can show a full picture of their money situation, how well they’re doing, and how their money is moving. This info is important for investors and lenders when they’re deciding where to put their money. It also helps everyone see if a company is going to last and what could possibly go wrong.

As you can see, bookkeeping and financial reporting do many important things for businesses. They give real, clear, and right-on-time info about money matters, helping businesses see how well they’re doing, pick smart moves, get folks interested in investing, follow the rules, and set up plans for what’s next. By keeping things accurate and sharing plain financial statements, businesses can fully get what’s going on with their money and do what they need to do to reach their goals.

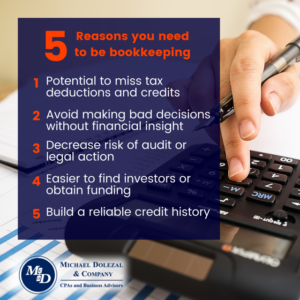

5 Reasons To Be Diligent With Your Bookkeeping

Ignoring bookkeeping can be a costly mistake for your small business. Here are five reasons why:

1. Missed Tax Deductions and Credits

Not paying attention to your money records could lead to big problems. You might miss out on important tax breaks, which means you could end up paying more in taxes and making less profit. If you don’t keep good records, you might not notice things you can actually take off your taxes—like office supplies, mileage, or meals. You may also forget about special tax benefits, such as getting money back for research or health care. Ignoring the numbers means losing out on money that could help your business grow. So, put keeping records at the top of your list to prevent expensive mistakes.

2. Making Poor Decisions Without Financial Insight

Lacking proper insights into your financing activities can result in suboptimal decisions. Bookkeeping offers valuable data about your business’s financial state, empowering you to make well-informed choices. It paints a clear picture of your revenue, expenditures, and overall profitability. Overlooking bookkeeping can result in mismanagement and financial instability.

3. Increased Risk of Audit or Legal Action

Not keeping careful track of your financial transactions can open doors for tax folks to look closely at or for possible legal arguments. Without solid bookkeeping, showing that you’re following tax rules or protecting yourself from money-related accusations gets tough. This can lead to costly audits, penalties, fines, or even legal action that could significantly impact your business’s reputation and financial stability.

4. Difficulty in Finding Investors or Obtaining Funding

Not keeping accurate money records can make things difficult when you want to show investors the real deal. They want clear info to figure out if you’re doing well and making money. Even folks who lend money look at your financial papers and how things went before they say yes to a loan. When your records are all over the place, it’s hard to prove how your money’s doing, which can make it tough to get the resources you need to make your business bigger.

5. Trouble Building a Reliable Credit History

Without proper bookkeeping, it becomes challenging to track your financial transactions, income, and expenses accurately. This lack of organized records can make it difficult for lenders and credit bureaus to assess your creditworthiness, leading to potential denials or higher interest rates when applying for loans or credit cards.

Furthermore, neglecting bookkeeping can lead to inaccuracies in your credit report. When lenders request your credit report, they rely on accurate and up-to-date information to evaluate your creditworthiness. Without precise records, errors or omissions may occur, negatively impacting your credit score and overall credit history.

Benefits of Bookkeeping and Financial Reporting

Let these six benefits of bookkeeping and financial reporting be the reason you start doing it! Don’t make the mistake of ignoring them in your small business.

1. Improved Accuracy of Business Records

Ensuring accurate business records comes down to dedicated bookkeeping and financial reporting. When meticulous records of financial transactions are consistently maintained, information remains precise and current. This facilitates informed decision-making based on dependable data.

Keeping your numbers in check also means catching any mistakes or mix-ups, so you can fix things in the correct period of time before it’s too late. When owners can really see how their business’s money is doing, they can smartly figure out things like how much to budget, where to spend, and even what might come next.

2. Access to Accurate Historical Data

Digging into the past is essential in bookkeeping and financial reporting. By diligently recording every transaction, bookkeeping provides dependable records that assist in recognizing trends and making well-informed decisions in real-time.

Making sure everything’s properly written down and stored is a key part of the process, ensuring the money info is organized and accessible. Precise historical data assists in keeping tabs on income, spending, and financial measures for monitoring well-being and future preparations.

3. Better Decisions Based on Accurate Data

Ensure you’re keeping tabs on your money movements. Document each dollar earned and spent. This practice enables you to grasp the broader financial health of your business. Examine your income sources and expenses. Pinpoint areas for potential cost reductions or profit increases. Such analysis aids in informed resource allocation and business growth decisions.

4. Simplified Tax Preparation

By maintaining accurate income and expense records yearly, you can easily provide an annual report of the information needed to complete your tax return, removing tax season stress.

Bookkeeping also tracks deductible expenses, optimizing deductions and minimizing tax liability. Financial reporting showcases business financial health, aiding financing and investor attraction.

Organized records and bookkeeping on a regular basis simplify tax prep and offer business advantages.

5. Secure Record Keeping for Compliance Requirements

Bookkeeping and financial reporting play a critical role in maintaining secure and compliant record-keeping practices. They ensure that precise financial records are kept in accordance with regulations and laws. By carefully tracking transactions, businesses can effectively present their financial well-being to auditors, tax authorities, and people who care about the company’s success.

Additionally, they prevent fraud. Detailed records quickly identify inconsistencies, ensuring asset safeguarding and financial transparency.

Types of Books Kept by Businesses

General Ledger (GL) Book

In the world of business, the General Ledger Book plays a crucial role. Think of it as a central hub where all your financial transactions come together, making sure everything is accurate and open. When this book is taken good care of, it holds a record of every money move you make: money coming in, money going out, things you own, and what you owe. These details are like puzzle pieces that help you figure out how your business is really doing.

A comprehensive GL book aids income and expense tracking over a period of time, which is vital for budgeting. Categorizing transactions into accounts, e.g., sales and inventory, aids financial analysis and risk identification.

Moreover, the GL book facilitates financial statement preparation—income statement, balance sheet, and cash flow statement—vital for stakeholder reporting.

Accounts Payable (AP) Book

Accounts Payable (AP) is vital for tracking owed money to suppliers, vendors, or creditors, ensuring financial obligations are met.

An AP book maintains systematic records of outstanding payments, aiding organization and timely payment. It monitors cash inflow and outflow, maintains supplier relations, and ensures financial health. It includes supplier details, invoice numbers, dates, and due amounts, offering a clear snapshot of current liabilities and facilitating reconciliation. A well-kept AP book prevents errors and improves financial management.

Accounts Receivable (AR) Book

Accounts Receivable (AR) is money owed by customers for delivered goods or services, representing a company’s payment right.

An AR Book tracks owed money, including customer name, amount, and due date, aiding payment tracking, cash flow management, and dispute resolution.

Inventory Control Books or Stock Records Books

Inventory control books, also called stock records books, are vital tools for businesses to manage inventory effectively. They track items, quantities, and locations, preventing stockouts or overstocking, which harm your business.

At the End of the Day

At the end of the day, bookkeeping and financial reporting serve several purposes in a business setting. They provide accurate, transparent, and timely financial information, enabling businesses to assess their performance, make informed decisions, attract investors, comply with legal obligations, and plan for the future. By maintaining accurate accounting records and providing clear financial statements, businesses can have a comprehensive understanding of their financial position and take the necessary steps to achieve their goals. This is true for both private companies and public companies, as financial accounting remains a cornerstone of their success.

Michael Dolezal & CO, CPAs & Business Advisors

As a small business owner, bookkeeping and financial reporting is a key piece of your business’s financial health. Looking for support with bookkeeping services or making other financial improvements to your business? We can help. Reach out to our team of experts today to ensure your business finances are the best they can be.