Do you know the difference between financial accounting and reporting and how it can impact your business decisions? Understanding the distinction between these concepts is crucial for effective financial management and decision-making. In this blog post, we’ll delve into the “financial accounting vs. reporting important differences you need to know,” and explore their purpose and components.

Table of Contents

- Financial Accounting: Purpose and Key Components

- Financial Reporting: Scope and Significance

- Key Differences Between Financial Accounting and Reporting

- Real-World Examples of Financial Accounting and Reporting

- Choosing the Right Tools for Your Business

- Key Takeaways

Financial Accounting: Purpose and Key Components

Financial accounting is all about generating financial statements, such as income statements, balance sheets, and cash flow statements, which provide an overview of a company’s financial position. Financial accounting promotes transparency and consistency in communicating financial information to stakeholders, such as investors, creditors, and industry regulators, by adhering to accounting standards like Generally Accepted Accounting Principles (GAAP).

Thus, financial accounting focuses on providing basic financial reports that reflect a company’s financial health.

Income Statement

The income statement is vital for assessing a company’s financial performance. It showcases a company’s revenues, expenses, and net income for a specific period. Income statements, which provide an overview of a company’s profitability, are essential components of financial accounting as they help evaluate the company’s financial health.

Balance Sheet

A balance sheet offers a snapshot of a company’s assets, liabilities, and equity at a particular moment. This financial statement is crucial for understanding the company’s financial position and assessing its ability to meet its obligations.

Balance sheets provide insights into a company’s assets and liabilities and are pivotal in financial accounting.

Cash Flow Statement

The cash flow statement is another essential component of financial accounting, providing an analysis of a company’s liquidity by delineating the cash inflows and outflows. These statements indicate the change in a company’s cash or cash equivalents over a specified time period, such as a quarter or fiscal year.

Cash flow statements, offering insights into how well a company manages its cash flows and meets its short-term obligations, contribute to a comprehensive understanding of its financial health.

Financial Reporting: Scope and Significance

While financial accounting focuses on generating financial statements, financial reporting encompasses a broader range of financial information. It serves various functions, such as compliance with regulations, aiding decision-making, and building stakeholder confidence.

Financial reporting, therefore, extends beyond financial statements, providing stakeholders with a more comprehensive view of a company’s performance and adherence to regulations and standards.

Compliance and Regulatory Requirements

Compliance with regulatory requirements is crucial for financial reporting, ensuring transparency and consistency. Adhering to regulations like GAAP and International Financial Reporting Standards (IFRS) helps maintain credibility among banks, investors, and regulators, facilitating approval of loans and lines of credit.

By complying with these standards, financial reporting guarantees uniform disclosure of information, enabling stakeholders to make informed decisions and evaluate the company’s financial health.

Decision-Making and Performance Analysis

Financial reporting plays a pivotal role in decision-making and performance analysis, as it furnishes pertinent and dependable financial information to:

- Corporate executives

- Investors

- Analysts

- Creditors

- Other interested parties

Financial reporting, providing insights into a company’s profitability, liquidity, and solvency, enables stakeholders to make judicious decisions based on the organization’s financial standing and performance. It also assists in assessing investment opportunities, analyzing financial risks, determining creditworthiness, and making strategic business decisions.

Building Stakeholder Confidence

Building stakeholder confidence is essential for financial reporting, as it helps maintain trust and credibility. Financial reporting promotes transparency and accountability in an organization’s performance and operations, ensuring uniform disclosure of information to stakeholders, including:

- Investors

- Employees

- Customers

- Regulators

Companies can cultivate trust and confidence among stakeholders by adhering to financial reporting standards and providing precise data in financial reports.

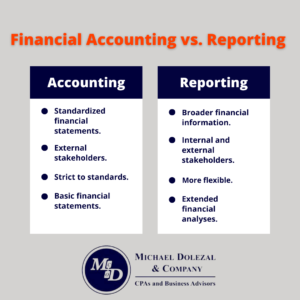

Key Differences Between Financial Accounting and Reporting

The key difference between financial accounting and reporting lies in their objectives, scope, and adherence to regulations and standards. While financial accounting focuses on generating standardized financial statements for external users, financial reporting caters to internal and external stakeholders, providing a broader range of financial information for decision-making and performance analysis.

Objectives and Users

Financial accounting serves external users, such as investors and creditors, by generating statements that accurately reflect a company’s financial position.

On the other hand, financial reporting caters to internal and external stakeholders, providing comprehensive information regarding a company’s performance and compliance with regulations and standards.

Scope and Detail

Financial accounting primarily focuses on standardized financial statements, including income statements, balance sheets, and cash flow statements.

In contrast, financial reporting covers a wider range of financial information, extending beyond financial statements to provide stakeholders with insights into the company’s performance, adherence to regulations, and decision-making processes.

Regulations and Standards

Financial accounting must adhere to regulations and standards established by governing bodies such as the Financial Accounting Standards Board (FASB) and the International Accounting Standards Board (IASB). These standards dictate when and how economic events are recognized and measured for financial reporting purposes.

On the other hand, financial reporting may include additional information beyond the standards set by GAAP and IFRS, providing stakeholders with a more comprehensive view of a company’s performance and adherence to regulations.

Real-World Examples of Financial Accounting and Reporting

Real-world examples of financial accounting and reporting include public company financial reports, such as 10-K and 10-Q filings, and internal management reports for decision-making. These examples illustrate the practical application of financial accounting and reporting concepts, providing stakeholders with valuable insights into a company’s financial health and performance.

By understanding the principles of financial accounting and reporting, stakeholders can make informed decisions about a company.

Public Company Financial Reports

Public company financial reports, such as 10-K and 10-Q filings, provide transparency and accountability to investors and regulators. These reports typically include financial data, such as financial statements, charts, illustrations, photos, and a letter from the CEO, as well as supplementary schedules and analysis of the company’s financial performance in the form of a financial report.

Public company financial reports providing this information serve as real-world examples of financial accounting and reporting in practice.

Internal Management Reports

Internal management reports are another practical example of financial accounting and reporting. These reports help businesses analyze performance, identify trends, and make informed decisions. Internal management reports play a crucial role in effectively managing a company’s resources by tracking progress, identifying improvement areas, and ensuring compliance with regulations and standards.

Internal management reports provide a comprehensive overview of a company’s financial health, ensuring that the company’s financial health and performance are well-monitored and analyzed.

Choosing the Right Tools for Your Business

Choosing the right tools for your business, such as financial accounting software and reporting solutions, can streamline processes and improve accuracy and efficiency. By automating and simplifying financial tasks, these tools save time and resources, minimize the risk of errors, and ensure compliance with relevant regulations and standards.

Whether you’re a small business owner or a finance professional in a large corporation, selecting the right financial tools can significantly impact your organization’s success.

Key Takeaways

- Financial accounting and financial reporting serve distinct objectives, catering to external and internal users respectively.

- Financial accounting must adhere to regulations and standards set by governing bodies such as the FASB and IASB to provide stakeholders with a clear view of a company’s performance.

- Choosing the right tools for your business can streamline processes, save time & resources, reduce errors & ensure compliance with regulations, contributing towards success.

Michael Dolezal & CO, CPAs & Business Advisors

As a small business owner, bookkeeping and financial reporting are key to your business’s financial health. Are you looking for support with bookkeeping services or making other financial improvements to your business? We can help. Reach out to our team of experts today to ensure your business finances are the best they can be.