It’s that time of year again – tax season is here! For many of us, the thought of preparing our taxes can be daunting, but it doesn’t have to be. In fact, with the right tools and information, you can maximize your refund and ensure that you’re filing the right forms. That’s why we’ve put together the ultimate tax prep checklist that you’ve been waiting for

Whether you’re a seasoned pro or a first-time filer, our comprehensive guide will walk you through everything you need to know to get your taxes done right. From organizing your documents to claiming deductions and credits, we’ve got you covered. So, sit back, relax, and let us take the stress out of tax season.

The IRS did a study a few years ago that computed that the *average* time that it takes to complete a tax return is 22 hours. And obviously, that number varies by the return, but I’m reminded (again) of the blessing that it is to free our clients’ TIME — not to mention the additional deductions we find, the stress we remove, and the security we can provide in knowing that it’s being handled right.

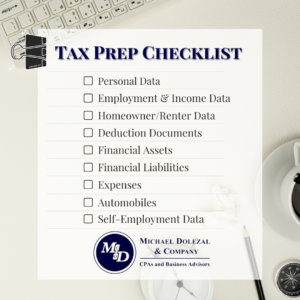

- Employment and income data

- w-2 forms from all employers

- unemployment compensation

- tax refunds (check last year’s tax return for this information)

- Form 1099-G miscellaneous (including rent)

- Form 1099-MISC partnership

- trust income

- pensions and annuities

- jury duty pay

- gambling and lottery winnings

- prizes and awards (including scholarships and fellowships)

- Health Insurance Information

- 1095-A forms from marketplace providers (if you purchased insurance through a marketplace)

- 1095 B form(s) showing health insurance coverage

- existing plan information (policy numbers, etc.)

- your unique Exemption Certificate Number (if you are claiming an exemption)

- records of credits and/or advance payments received from the Premium Tax Credit (if claiming)

- Personal Data

- Social Security number and birthdates of the filer, the filer’s spouse, and each dependent of the filer

- Child care provider tax I.D. or Social Security Number (if applicable)

- Bank account information (so you can set up direct deposit for refund purposes)

- Tax I.D. numbers for any business you operate (if applicable)

- Records of charitable donations and other deductions

- Gifts to charity (receipts for any single donations of $250 or more)

- Unreimbursed expenses related to volunteer work

- Unreimbursed expenses related to your job (travel expenses, entertainment, uniforms, union dues, subscriptions)

- Child care expenses

- Medical Savings Accounts

- Tax return preparation expenses and fees

- Education expense information

- Proof of payments or receipts for tuition

- Student loan interest Form 1098-e (if applicable)

- Income statements for interest and investments

- Form 1099-INT & 1099-OID

- Form 1099-DIV (income from dividends)

- Proceeds from broker transactions Form 1099-B

- Retirement plan distribution Form 1099-R

- Capital gains or losses

- All other financial liability information

- Auto loans and leases (account numbers and car value) if vehicle used for business

- Early withdrawal penalties on CDs and other fixed-time deposits

- Self-employment Data (if applicable)

- Estimated vouchers for the current year

- Self-employment SEP plans

- Self-employed health insurance K-1s on all partnerships

- Receipts or documentation for business-related expenses

- Homeowner/Renter Data

- addresses of any place you were a resident over the course of the tax year

- Mortgage interest Form 1098

- Form 1099-S (if you sold a home or other real estate)

- proof of real estate taxes and rent paid during the tax year

- Other Deduction Documents

- IRA, Keogh and other retirement plan contributions

The list above is not exhaustive but gives an idea of various items that may be necessary to properly your returns, whether doing so alone or with a professional tax preparer. It’s important to check all required documents carefully before submitting a return, as mistakes can lead to costly errors. Additionally, accurate records from prior years (including the prior year’s return) may be useful in accurately representing prior period data when filing your a state or federal return.

Maximizing Your Refund on Your Federal and State Returns

To ensure that you receive the maximum refund on your tax return, there are a few key steps you can take.

- Claim Deductions and Credits

Make sure that you claim all of the deductions and credits that you are eligible for such as education expenses, charitable contributions, and business-related expenses. Keep all documentation of these expenses so that you can provide proof if necessary. - Accurately Report Income

Ensure that you have accurately reported all of your income. Don’t forget other income categories (things like freelance or side income you may have earned). - Work with a Tax Professional

Consider consulting with a tax professional or using tax preparation software to help identify all of the deductions and credits you may be eligible for.

Additionally, tax experts will keep up with any changes to the tax code or tax laws that may affect your eligibility for certain deductions or credits. - File On Time

Be sure to file your tax return on time and pay any taxes owed in full to avoid penalties and interest.

The Right Tax Forms For You

Knowing which tax forms to use can be a bit confusing, but there are a few things you can do to determine which forms are right for your filing.

- Identify your filing status.

Your filing status (single, married filing jointly, married filing separately, head of household, or qualifying widow or widower) will determine which forms you need to use. - Determine your sources of income,

The types of income you have (such as wages, self-employment income, rental income, or investment income) will also determine which forms you’ll need to file. - Check the IRS website.

The IRS provides a range of resources to help taxpayers determine which forms they need to file. You can use the IRS’s Interactive Tax Assistant tool or the Tax Forms and Publications page on the IRS website to find the appropriate federal tax forms.

Overall, the best way to determine which forms to file is to take the time to understand your income sources and filing status. By doing so, you can ensure that you file an accurate and complete tax return.

Michael Dolezal & CO, CPAs & Business Advisors

Looking for support as your prepare to file taxes for yourself or your business? Whether preparing your federal tax return or your state and local returns, we’re here to help. Reach out to our team of tax experts today to ensure you’re filing is correct, timely, and maximizes your refund.